Africa Emerging as Alternative Source for Rare Earths as Global Supply Chains Shift

Rivalry for Rare Earths Reach Africa

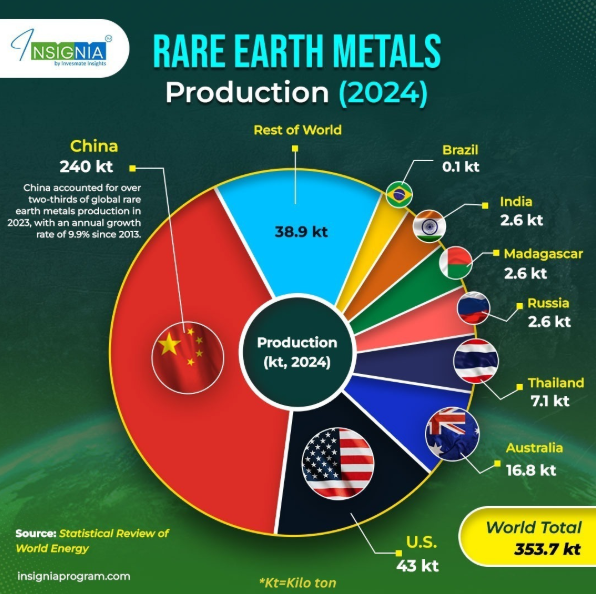

Based on the trend of Rare Earth Elements (#REE) projects in the pipeline in Africa, it is projected that Africa will account for 10% of the global supply of Rare Earths by 2030. Currently, there are nine REE projects under development across the continent.

Recently, #RareEarths have become a focal point in the trade war between the US and China. China basically controls the global REE market as it processes nearly 90% of all the rare earths. Therefore, some countries are scrambling to secure alternative sources. Rare Earth Elements are a subset of #CriticalMinerals that are needed in aerospace, smartphones, medical scanners and electric vehicles (#EV). Rare Earths can be categorized into light or heavy, with the heavy being more valuable and used in military equipment. They are thus essential for #NationalSecurity and the #EnergyTransition.

Angola Longonjo

In Angola, the Longonjo mine is set to supply up to 5% of global needs for neodynium and prasedymium. The UK-listed Pensana has secured a USD 268 million financing package during its first round of funding. It is backed by Absa Bank and Africa Finance Corporation.

Pensana has also signed a partnership with US firm ReElement Technologies. This REE mining project is part of the larger #LobitoCorridor, which is being supported by both US and EU.

Burundi Gakara

Gakara mine is located in northern Burundi near the border with Rwanda. It is situated some 20 kilometers from the Bujumbura-Kigali corridor making transportation quite convenient. The deposit consists mainly of carbonatite-related veins inside Proterozoic rocks. Gakara distinguishes itself by its grade (15-20% TREO) and composition. Despite its small size, it contains heavy REE such as Nd, Pr, Dy, Tb and Y and is one of the best grades of REE ever mined.

Rainbow Rare Earths has the mining license and has started operations since 2017. Burundi will not be a game changer by volume, but it will remain an important niche provider of heavy REE.

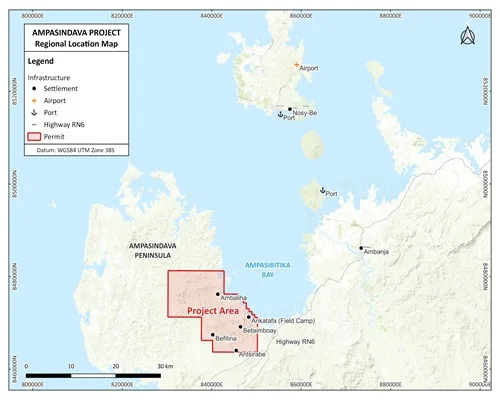

Madagascar Ampasindava

The Ampasindava mine is the largest known, outside of China, ionic adsorption clay deposit, which is less costly to mine than hard rock. It has an estimated reserve of more than 600 million tonnes of total rare earth oxides (TREO), containing Dysprosium, Neodymium, Praseodymium, Terbium, and other REE, at 868 ppm. It is owned by Tantalum Rare Earth Malagasy, a subsidiary of Harena Resources.

Malawi Songwe and Kangankunde

In Malawi, the Songwe Hill and Kangankunde REE mines are under development. The EU designated the Songwe Hill Mine as a ‘strategic project’ under the Critical Raw Materials Act in 2025. Based on the feasibility studies, Songwe is expected to produce nearly 2,000 tonnes of NdPr and 56 tonnes of DyTb oxide annually over 18 years.

Meanwhile, the Kangankunde project has just passed the Final Investment Decision and is expected to commence production by late 2026. In August 2025, the mine developer, Lindian Resources, sealed a 15-year offtake agreement with Australia’s Iluka Resources to supply 6,000 tonnes of monazite concentrate per year.

Namibia Lofdal

Namibia Critical Metals Inc. controls a deposit in Lofda which contains substantial reserves of dysprosium and terbium. It has formed a JV with JOGMEC, a Japanese state agency, for cooperation on exploration and exploitation. Namibia is particularly interesting as it has notable amounts of heavy REE, including Nd, Pr, Dy, Tb, and Y.

South Africa Phalaborwa and Steenkampskraal

South Africa is dusting off some old rare earths mines and finding new value in tailings. Rainbow Rare Earths is redeveloping the Phalaborwa mine in Limpopo province by extracting Nd, Pr, Dy and Tb from discarded rocks from the mining of phosphogypsum. US DFC holds a 12% share in Rainbow through its Tech Metals Fund TechMet, and plans to inject USD 50 million in exchange for the equity.

Steenkampskraal is an old monazite mine in Western Cape province. The new owner, Stenkampskraal Holdings, is planning to restart operations and is actively looking for private equity interest.

Tanzania Ngualla

According to JORC, the Ngualla mine was initially onwed by Australian Peak Rare Earths and has an estimated reserves of 4.6 millions tonnes of Rare Earth Ores. Then, Shenghe Resources, via subsidiary Chenguan), moved to acguire a stake in Peak with the intention to buy out the outfit eventually. The offer on the table was to pay AUD 158 for full control of Peak. As part of the deal, 100% of the output of Ngualla mine will be sold to Shenghe Resources and exported to China.

(Source: Statistical Review of World Energy)

Uganda Makuutu

The Makuutu mine in Uganda is owned by Ionic Rare Earths and is one of the rare ionic adsorption clay deposits in the world. As an open-pit and clay deposit, the cost of extraction and processing is reduced, rendering Makuutu highly attractive for investors. Makuutu has reserves of 315 million tonnes of TREO at 200 ppm grade.

Zimbabwe Chilonga

A geological survey of Zimbabwe reveals the existence of the Zimbabwe Craton, flanked by Proterozoic belts and dotted with alkaline and carbonatite complexes, typical hosts for REE. The geology indicates the presence of light REE, with preliminary analysis indicating the presence of La, CE, Nd and Pr. Traces of Sm and Y have also been detected.

The Chilonga in Masvingo province is the flagship REE project in Zimbabwe. It has large reserves with low-to-moderate grade with strong Nd-Pr content. Dorowa was historically a phosphate mine, with REE occurring as by-products. The tailings at Dorowa contain traces of La and Ce, and some Nd, but the tonnage is quite significant.

Too Little Too Late

Some analysts believe that even with a dozen new REE mines coming into operation, it will hardly make a dent in the dominant position of China. The diversification process will certainly help to derisk the supply chain, but substantial investments are required not just upstream in extraction, but also downstream in processing.