Zijin Gold International’s IPO on HKEX Raises Record $3.2B

On Monday, 29 September 2025, Zijin Gold International made its debut on the Hong Kong Stock Exchange (HKEX) and managed to raise USD 3.2 billion. Zijin Gold is the second largest IPO on HKEX after that of CATL, which raised USD 5.3 billion earlier. By 10 am local time, the share price of Zijin surged by 60% to HKD 119, boosting the market cap of the company to over HKD 300 billion.

Among the institutional investors who backed the Zijin Gold, it is worth noting BlackRock, Fidelity International, Hillhouse Investment, Millennium Management, and GIC, one of Singapore’s Sovereign Wealth Funds (#SWF).

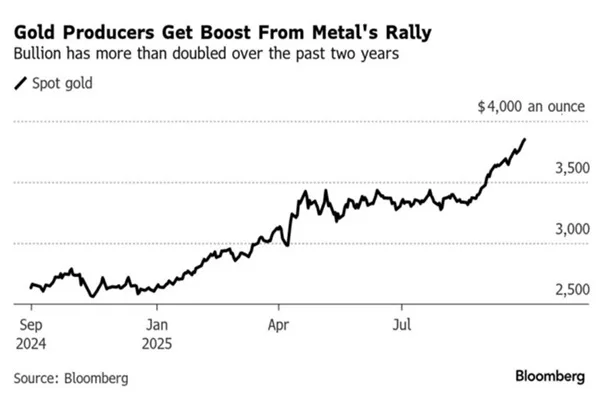

Zijin Gold International is a spin-off of Zijin Mining, which will specialize in the #gold business in overseas markets outside of China. The IPO was timed to correspond to a period when #gold prices also reached record peaks, with spot price flirting with USD 4,000 per ounce, compared to about USD 2,500 in September 2024.

The listing of Zijin Gold follows the hugely successful IPO by PT Merdeka Gold Resources on the Jakarta Stock Exchange earlier this month. At that time, Merdeka Gold became the largest IPO in Indonesia so far this year by raising USD 280 million from the stock market.

In a public statement, Zijin Gold revealed that the proceeds will support its global expansion. In particular, it plans to acquire a mine in Kazakhstan and upgrade other mines around the world. Other than Central Asia, Zijin also possesses gold assets in Australia, Africa, and South America.

At the closing bell, the share price of Zijin Gold closed at HKD 120.60 on Tuesday, raising its valuation to HKD 316.5 billion ($41B). With this successful IPO of its subsidiary Zijin Gold, the parent company Zijin Mining Group’s total valuation surpassed USD 100 billion and is now ranked as the world’s third-largest mining company, behind BHP and Rio Tinto.