Africa and Energy are Focus of China’s Investments According to Griffith University BRI Report 2025

On 18 January 2026, Griffith University released its annual Belt and Road Initiative (#BRI) Report for 2025. Under BRI in 2025, China #ODI reached USD 86.2 billion and signed USD 128.4 billion worth of construction contracts.

China signed 350 #BRI deals in 2025, compared to 293 in 2024. The total amount in 2025 was USD 213.6 billion, representing nearly a 75% increase compared to USD 122.6 billion in 2024. The latest cumulative value of BRI contracts has now reached USD 1.4 trillion since its inception in 2012.

From a sectoral perspective, the energy sector, including oil & gas, was the largest beneficiary of Chinese largesse with USD 93.9 billion, more than double compared to 2024. In the green energy sector, including solar, wind and waste-to-energy projects, China initiated USD 18.3 billion of projects with a total generating capacity of 22 GW.

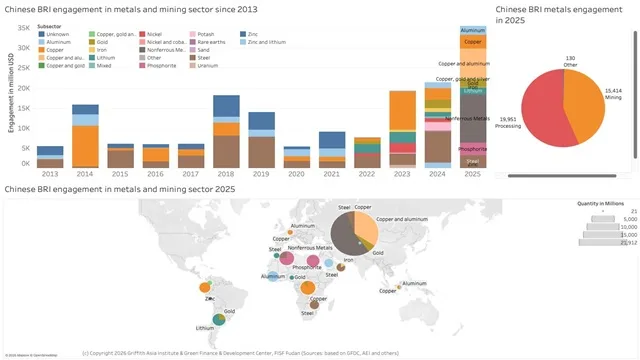

The second key sector is mining, which attracted some USD 32.6 billion in investments. Kazakhstan alone received USD 15 billion in Chinese FDI to develop its mining sector. Another sector that stood out is #copper as the brown-red metal is in huge demand for EV and AI data centers. To facilitate access to the #Copperbelt region, China, Tanzania, and Zambia kicked off the rehabilitation of #TAZARA with a price tag of USD 1.4 billion in 2025.

From a geographical point of view, Africa is the region that attracted the most Chinese interest. In 2025, Africa registered USD 61.2 billion in FDI from China. Two of the largest projects were energy projects in Nigeria ($24.6B) and the Republic of Congo ($23.1B), with Saudi Arabia ($19.8B) not far behind.

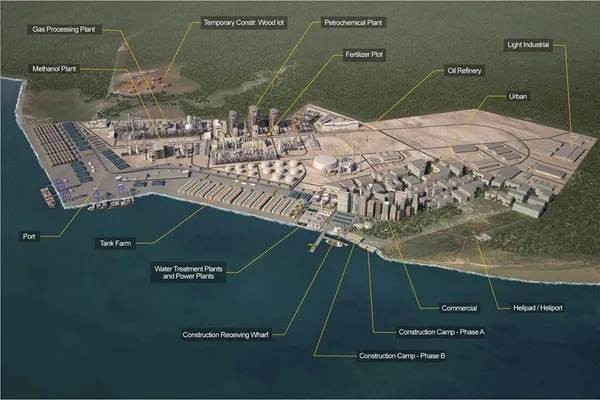

In Nigeria, China National Chemical Engineering is implementing the Ogidigben Gas Revolution Industrial Park (#GRIP) project. In the Democratic Republic of Congo, China plans to build the Sino-Congolese Industrial City, targeting the creation of 1,200 factories mostly from China, with total investments reaching USD 12 billion eventually.

In Congo Brazzaville, China’s Southern Petrochemical Group is investing to secure and develop three blocks at Banga Koyo, Holmoni, and Cayo to produce up to 200,000 barrels per day by 2030. In addition, the Republic of Congo signed a USD 9.4 billion contract to construct the Sounda Hydroelectric Power Plant (#HPP).

China National Nuclear Corporation is building the USD 89 million PV plant in Namibia, which will be the largest when finished. Namibia is also an important supplier of uranium to China, which can either be used as a nuclear fuel or enriched for atomic weapons. In Egypt, Xinyi Glass is investing USD 700 million to produce 1.5 million tonnes of solar glass panels annually as part of China’s efforts to delocalize its overcapacity in PV manufacturing to markets with high-growth potential. LONGi Green Energy has also invested in Nigeria to produce Green Hydrogen (#GH2).

China’s investments in Africa appear to be geared toward securing and diversifying its energy supply, with new green energy deals as an emerging trend. In 2025, China imported nearly 12 million barrels per day, which translates to nearly 580 million tonnes annually. Currently, Africa accounts for 10% of its oil imports, with Angola, Libya, Nigeria, the Republic of Congo, and Gabon as the Top Five.

Some analysts have suggested that the figures presented by China tend to be over the top, especially if it is construed as a ‘ resource for infrastructure’ swap. Thus, Tanzania canceled the USD 10 billion #Bagamoyo Port project, calling it exploitative, while the DRC renegotiated its ‘deal of the century’ involving coltan and copper with China as well. To ensure it is not getting the short end of the stick, Angola also plans to diversify its development partners with the #LobitoCorridor, after its USD 100 billion deal with China involving oil for infrastructure.