Coffee: Brazil’s Pain, Africa’s Gain

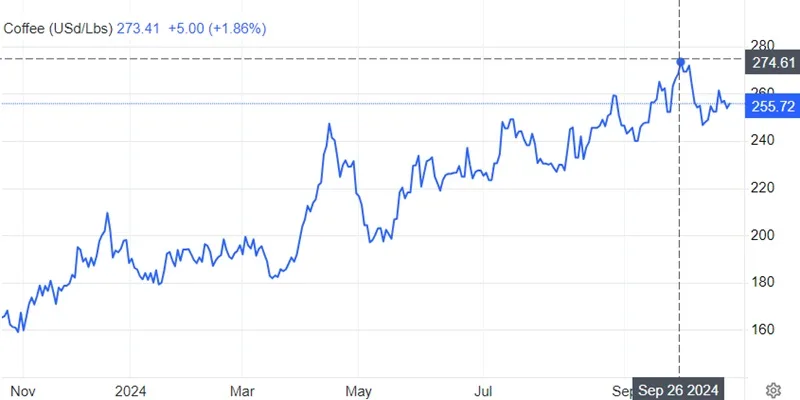

As Brazil faces drought that will negatively its coffee bean harvest, world coffee bean prices have shot up. The region that looks most likely to gain is Africa with Ethiopia, Kenya, Uganda and Cote d’Ivoire being coffee producers.

Since April 2024, Brazil has experienced below average rainfall affecting the flowering season of the coffee plants. Brazil is the world’s largest producer of arabica coffee and lower output is affecting coffee price.

Vietnam is the largest global robusta coffee producer, but it is in no better shape than Brazil. Typhoon Yagi struck Vietnam in September 2024, causing damage to vast swathes of coffee plantations. Demand is going up as more and more Chinese, especially the younger generation, shift from tea to coffee.

In 2023, the global market size for arabica is estimated at USD 60 billion. For robusta, the global market roughly amounts to US 20 billion. Arabica is preferred in the US while robusta is preferred in Europe.

For instance in Kenya, a 50-kg bag of coffee beans is now fetching for USD 256 in October 2024 compared to USD 241 in September 2024. Ethiopia also stands to gain as it exported 298,500 tonnes of coffee beans for USD 1.43 billion during the 2023-2024 fiscal year. The Uganda Coffee Development Authority also reported record earnings from coffee exports with a high not seen in 30 years.

With declining inventories, prices are expected to remain high until the next season, assuming the climate improves. On 3 October 2024, the Intercontinental Exchange (ICE) reported that arabica coffee stocks dropped to a four-month low of 795,874 bags while robusta coffee stocks also hit a 5-month low of 4,191 lots.

Although we are not in a situation of shortage, the general trend is that lower inventory levels are pushing coffee prices up.