Have Gold and Silver Prices Peaked?

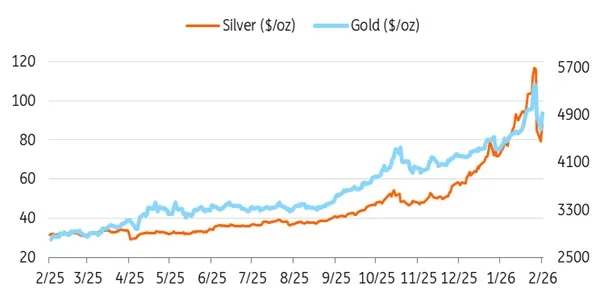

On 2 February 2026, the prices of gold and silver dropped by 4.5% and 6.5%, respectively, at the end of the trading day, after reaching record levels. Does that signal that the party is over? Is its just profit-taking by some institutional investors? Or is there room for more growth?

Before the price of gold dropped, it hit a record level of nearly USD 5,600 per ounce, while silver was trading at a record high of USD 122 per ounce. It has been fashionable to blame everything on Trump, and one must say that the unpredictability he brought to the market did convince some investors to seek ‘refuge assets’ such as gold and silver.

As a matter of fact, several central banks are ditching the dollar from their reserves and are hoarding #gold and silver instead, believing these precious metals to be a safer bet than the mighty dollar.

The #BRICS have been pushing for a new currency backed by gold, in an attempt to dilute the ‘dollar hegemony.’ Although a new single currency for BRICS might still be some distance away, the current consensus among BRICS countries is to trade using national currencies, thus bypassing the dollar as the preferred currency for international trade.

During the first week of February, the Chinese journal Qishi republished one of Xi Jinping’s old speeches, in which he declared China’s ambitions to make the renminbi (RMB) a global reserve currency. He also directed Chinese banks to pare down their exposure to US Treasury Bills. That signal sent shockwaves to the White House, who are quite touchy when it comes to protecting the position of the American dollar.

In that context of trade turmoil and geopolitical contestation, gold and silver appear to still have a bright future. JP Morgan analysts predict that gold will reach USD 6,300 per ounce by the end of 2026. The price of gold will keep rising as long as the dollar continues its depreciation and central banks keep buying gold bullions.