Chinese HNWI Seek Eldorado in Singapore

Faced with an ‘unfriendly environment’ in China, Chinese High Net Worth Individuals (#HNWI) are taking their money out of China. Many of them have thus picked Singapore as their new home.

The rich Chinese seem to be voting with their feet as China cracks down on corruption, reins in real estate and tightens control on private enterprises. As the ‘Switzerland of Asia’ and with a majority 70% population of Chinese ethnicity, the Chinese nouveaux riches find themselves at home and their cash to be safer in the Lion City.

The preferred way is to acquire a Singaporean Permanent Residence (#PR) as an investor. Around 200 people were granted PR via the Global Investor Program (GIP) between 2020 to 2022. The scheme has turned out to be so popular that the Singaporean government decided to raise the investment bar from S$ 2.5 million to S$10 million in March 2023.

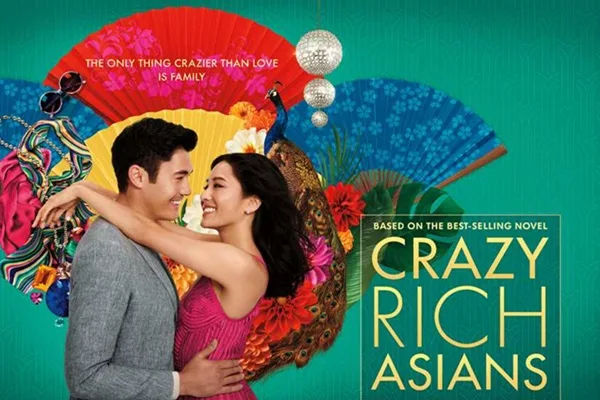

Well-heeled Chinese flocking to Singapore is not a new phenomenon and, back in 2018, the trend even inspired a movie entitled ‘Crazy Rich Asians’. The movie went on to become a blockbuster as it raked in USD 239 million globally and gave a rare peek into the lives of the rich and famous Chinese families. However, the migration wave seemed to have picked up renewed momentum recently.

Typically, the money influx goes into a Family Office (#FO) or a Variable Capital Company (#VCC). According to statistics compiled by the Monetary Authority of Singapore (MAS), Single Family Offices (SFO) rose from 400 in 2020 to 1,100 in 2022. As for Multi-Family Offices (MFO), their number shot up to 800 from only 100 in 2018. In addition, more than one thousand of VCC have been established or re-domiciled in the Singapore jurisdiction during 2023 so far.

Finding out how much the Crazy Rich Chinese actually ‘invested’ into Singapore is apparently as hard as getting a peek at the gold reserves stored at Fort Knox. The shroud of secrecy has raised suspicions of money laundering and some assets have actually been frozen while under #AMLCFT investigation.

By some estimates, the value of assets belonging to wealthy Chinese which is currently frozen amounts to about S$3 billion. Needless to say, it would be safe to assume that this figure only represents the tip of the iceberg.

When asked whether the crackdown by Singaporean authorities on the rich Chinese was undertaken at the request of the Chinese government, Singaporean officials categorically denied any pressure or interference from Beijing in connection to recent money laundering investigations involving Chinese nationals residing in Singapore.

“There has been some speculation circulating in news outlets – internationally and domestically – that this operation was carried out at the behest of China. This is completely untrue!”

Singaporean 2nd Minister for Home Affaires Josephine Teo

The Crazy Rich Chinese appear to have a marked taste for high-end real estate, fancy cars and exclusive golf club memberships. According to property consultancy OrangeTee & Tie, nearly one-quarter of the 425 luxury home purchases — valued at least S$5 million — can be attributed to rich Chinese immigrants. Unsurprisingly, Singaporean residential home prices experienced a 14% uptick last year.

To cool the market, the Singapore government had to introduce a stunning 60% property tax for foreign buyers in April 2023. As a result, the foreign proportion of property transactions dropped from 7% in 1Q23 to 4% in 3Q23.

Similarly, Singapore had to raise the tax on luxury cars from 220% to 320% for vehicles costing S$80,000 or more in an attempt to put a brake on fancy car acquisition by the Chinese billionaires.

Some 5,500 km towards Africa and to the west of Singapore lies the paradise island of Mauritius which has been trying to mirror the success of the Lion City as an International Financial Centre (IFC). As a matter of fact, both are small island states with many similarities. For instance, if Singapore is called the Switzerland of Asia, then Mauritius is sometimes referred as the Switzerland of Africa.

The Mauritius #IFC has also recently introduced Family Offices and Variable Capital Companies in a bid to lure the opulent to its shores. While Singapore is 70% Chinese, Mauritius is 60% Indian. In a similar fashion to Singapore, Mauritius has been trying to attract the affluent Indians who have a propensity to spend lavishly on Big Fat Weddings.

As an African elite emerges, some have also picked Mauritius to park and fructify their fortune. However, when Africans come to Mauritius, they find the islanders to be mostly Asian and the visitors mostly European.

On the property side, Mauritius developed a full range of offerings from IRS, RES and deluxe apartments to cater to every level of wealth. However, the Private Banking and Wealth Management sector appears to be at the start of the learning curve. But as Africa and India emerges, Mauritius appears ready to unfurl the red carpet to welcome the wealthy with their wallets.