Ethiopia Defaults on Sovereign Bond

Ethiopia failed to effect a payment on its sovereign bond. On 26 December 2023, a USD33 million payout became due, but the Government of Ethiopia was unable to make good on its promise. The payment is due on the USD one billion government-issued #EuroBond.

The payment deadline was set at 11 December 2023 with a grace period of 14 days. With Christmas falling 25th of December, Tuesday the 26th of December became the final day for Ethiopia to pay the interest on the bond.

Ethiopian Finance Minister warned of “acute external liquidity pressures” earlier on and expressed the wish for “all creditors to be treated on an equal footing.”

In the wake of COVID, Ethiopia thus becomes the 3rd Africa to default on its debt after Zambia and Ghana. It is worth noting that in addition to the pandemic, Ethiopia had to deal with a civil war, compounding its economic woes.

In 2021, Ethiopia requested a suspension of debt payments due to the war in the northern Tigray region. An in-principle agreement was reached with bilateral creditors then.

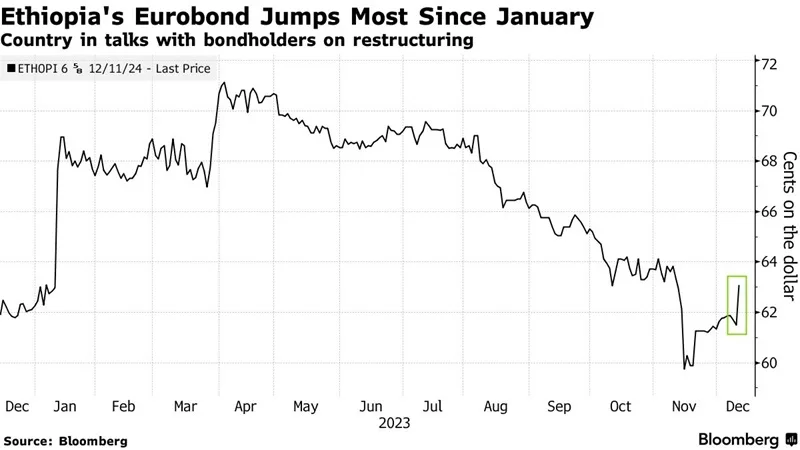

At the eleventh hour, Ethiopia convened a bondholder conference call. The prospect of reaching deal produced a glimmer of hope resulting in an uptick of the bond price.

The Government of Ethiopia proposed to extend the maturity of the bond from July 2028 to January 2032 and to reduce the interest from 6.625% to 5.5%. Unfortunately, no last-minute deal was sealed, and it looks like the default process will run its course.

The total face value of the bond will remain at USD one billion, thus guaranteeing bond holders will not lose their capital but would have to accept a lower yield. Consequently, credit ratings agencies Fitch and S&P downgraded Ethiopia sovereign rating to ‘junk status.’

According to the IMF, the Debt to GDP ratio of Ethiopia is reported to be 46%, which is not considered very high. It is believed that Ethiopia will join Ghana, Zambia and Sir Lanka to negotiate its external debt based on the #G20 Common Framework.