2024 AfDB Annual Meeting Calls for Reform of Global Financial Architecture

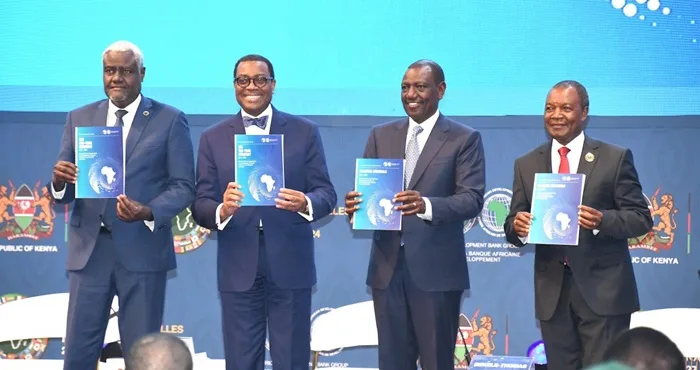

The African Development Bank (AfDB) held its 2024 Annual Meeting at the Kenyatta International Conference Center (KICC) in Nairobi from 27 to 31 May 2024. The theme of this year meeting was “Africa’s Transformation, the African Development Bank Group, and the Reform of the Global Financial Architecture.”

It is worth noting that 2025 will mark the 60th anniversary of the AfDB. Therefore, the AfDB has started working on its ‘Vision at 60’ paper in order to find new strategies for financing the transformation of Africa amidst global financial challenges. Some 3,000 delegates, including heads of state or government, ministers, central bank governors, private sector, and other stakeholders attended the meeting.

During the 59th Annual Meeting in 2024, the AfDB released its yearly publication ‘African Economic Outlook’, which provides policymakers with comprehensive analysis and forecasts of the economic performance of African countries. It also looks into common challenges and interests that the bank has at heart such as #ClimateChange, Private Sector Development and Innovation.

In order to achieve the UN Sustainable Development Goals (#SDG) by 2030, #UNECA estimated that Africa will need at least USD 1.3 trillion annually. To bridge the financing gap, it is imperative to reform the international financial system in order to meaningfully accompany Africa in its journey towards SDG.

“It’s a major demonstration of the faith and the confidence our shareholders have in us, and our ability to use our resources well to mobilize additional capital to do even more.”

AfDB President Akinwumi Adesina

One of the first concrete step taken by the Board of Governors of the AFDB was to increase the General Callable Capital of the bank by USD 117 billion, from USD 210 billion to USD 318 billion. The increase in callable capital will allow AfDB to respond better to its member countries substantial finance needs.

At the Meeting, the AfDB also unveiled its Ten-Year Strategy. The Strategy identified the youth as one of the most important assets of Africa. Furthermore, the Strategy places ‘considerable emphasis’ on adaptations and mitigations necessary to address the adverse effects of Climate Change.

“Recognizing Africa’s vulnerability to climate change, the Bank will promote low-carbon development pathways aligned with the Paris Agreement while safeguarding biodiversity and nature.”

African countries are pushing for an implementation of the commitment taken by developed nations to channel the Special Drawing Rights (SDR) to countries in need through MDB such as the AfDB. Technically speaking, the SDR can be classified as Hybrid Capital Instruments and treated as equity on balance sheets in order not to negatively impact the credit ratings of MDB. Currently, the AfDB is a Multilateral Development Bank (MDB) which enjoys an AAA rating. Countries receiving financing derived from SDR can consider them as ‘reserves’, and not ‘debt’.

In 2021, the IMF disbursed USD 650 billion in SDR in the wake of the #COVID19 pandemic. However, Africa received only USD 33 billion, representing only 5% of the total allocation and the amount was the smallest among all the regions in the world.

At its annual summit in February 2022, the African Union (AU) urged developed countries to increase the SDR allocation to Africa to at least USD 100 billion and to channel part of the allocation through AfDB. The multiplier effect of the re-channeled SDR will significantly enhance the lending capacity of the MDB.

Another hot topic at the Meeting was the Sovereign Credit Ratings system. There is clearly a bias against Africa who have to bear a ‘high-risk profile’ and the issue of ‘Africa Debt Premium’ causes the cost of capital to be onerous.

However, the data shows that default rates in Africa are actually lower than in other parts of the world. According to Moody’s, the default ratees in Africa is 5.5%, compared to 8.5% in Asia and 13% in Latin America.

Some African leaders believe that one solution would be for Africa to set up its own credit rating agencies. According to a study, biases on sovereign credit ratings cause African countries to unnecessarily fork out more than USD 75 billion annually.

The source of financing in Africa has also evolved according to a study by AfDB. In 2000, bilateral debt was the largest contributor at 52%, but now accounts for only 27%. On the other hand, commercial debts which was 20% in 2000, now represents 43% of the total debt. Commercial debt usually come at higher interest rates compared to concessional rates for bilateral debt or financing from MDB.

Total external debt of Africa was USD 1.12 trillion in 2022 and edged up by USD 30 billion to USD 1.152 trillion in 2023. In 2024, Africa is expected to pay out USD 163 billion just to service debt, up sharply from USD 61 billion in 2010.

One of the possible ways to make financing less costly and more accessible is to leverage local sources. Unfortunately, Domestic Resource Mobilization is still low in many African countries, with median tax-to-GDP ration standing at 14%, leaving perhaps some room to maneuver. However, from a populist perspective and due to the large informal sector in many African countries, increasing the tax burden might prove a challenge.

Another proposal put forward was to leverage the continent’s vast natural resources to unlock financing. In that regard, the AfDB has published a guideline document to resource-rich countries on how best to negotiate better taxes and royalties on their mineral resources. In the same line of thought, Africa will miss the boat of development if it does not industrialize and undertake more Local Value Addition (#LVA).

In the end, the African leaders called for a different way to evaluate Africa which will take into account not only its huge mineral resources, but also its potential for renewable energies and capacity to feed the world with 60% of the world arable land. The African Paradox is that the Africa is resource-rich but cash-poor. The narrative on Africa must change from the ‘region of high-risk’ to the ‘land of opportunity.’