Gulf Cooperation Council Emerges As One of the Top Investors in Africa

In December 2024, Afreximbank released its research report on “Rising Gulf Investments in Africa“, highlighting the increasing and sustained appetite of Gulf Cooperation Council (GCC) countries for Africa. The #GCC consists of six member states, namely, Bahrain, Kuwait, Oman, Saudi Arabia, Qatar and UAE.

For 2024, Africa’s overall #GDP is expected to exceed USD 3 trillion with an average economic growth between 4% and 5%. If Africa were a single country, Africa would rank as the 5th or 6th largest economy in the world. But its large population of over one billion brings down the per capita GDP to just USD 2000.

Given the relatively low base and vigorous growth rate, it is not surprising that other countries are stepping up their #ODI level into Africa. The Gulf countries are no exception. Geographically and culturally close to Northern Africa, the Gulf countries have started to venture southwards, and their footprint can now be seen across Africa.

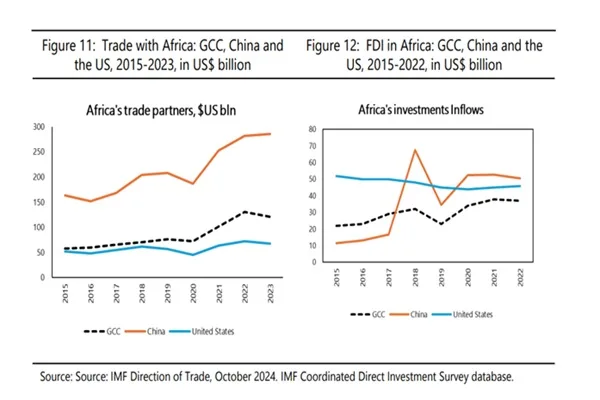

According to data compiled by the International Monetary Fund (IMF), #FDI into Africa from GCC Countries reached USD 40 billion in 2022. The investment level into Africa compares favorably to the USD 45 billion from the USA and the USD 50 billion from China.

In 2023, the GCC bloc pledged 73 investment projects worth a total of USD 53 billion across Africa. Based on these estimates, GCC has emerged as the 3rd largest source of FDI into Africa, behind China and USA.

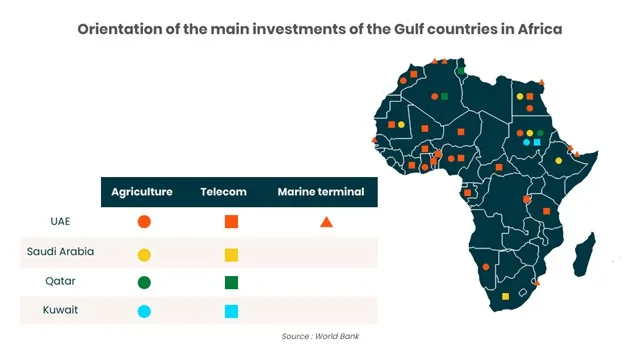

The investments went into diverse sectors such as agriculture, telecoms, energy and logistics. Previously, investments went into the familiar territory such as the Oil & Gas sector, but the economic diversification strategy of Africa appears to be successful in attracting FDI into other sectors.

One such focus sector for GCC is agriculture. Being mostly desertic, the GCC states have to import most of their food while Africa has abundant arable land. Thus, it became natural for GCC states to invest in agriculture in Africa to ensure their #FoodSecurity. Additionally, the GCC is promoting #SmartAgriculture which adopts new technologies such as drones and #AI.

To improve the investment climate, the Afreximbank put forward the following recommendations:

- Align investment strategies closely with National Development Plans (#NDP)

- Leverage Public-Private Partnership (#PPP) to ensure viability

- Adopt fiscal and monetary policies to enhance Ease of Doing Business (#EDB)

Based on the IMF, the average growth rate of Sub-Saharan Africa will accelerate from 3.6% in 2024 to 4.2% in 2025. As a matter of fact, among the Top 20 fastest economies in the world, 11 are in Africa. Thus, the economic outlook on Africa is quite positive and foreign investments are expected to maintain a substantial level going forward.