Global Investment Summit Brings in £30B for UK

On the 27th of November 2023, the 2nd Global Investment Summit (#GIS2023) opened at Hampton Court Palace in London. The first edition of the Summit happened in 2021 and it is a flagship event organized by the UK Department for Business and Trade.

The Summit gathered more than 200 top global CxO to look at the UK as an investment destination. Among the asset managers and institutional investors in attendance, there were Amanda Blanc of Aviva, Stephen Schwarzman of Blackstone, David Soloman of Goldman Sachs and Jamie Dimon from JP Morgan Chase. Fortune 500 companies and global brands such as Aston Martin, BioNTech, McLaren, Microsoft, Nissan and Tata were also represented.

“Attracting global investment is at the heart of my plan for growing the economy.”

UK PM Rishi Sunak

In his keynote address which amounted almost to a sales pitch for UK, PM Rishi Sunak was proud to announce that his country received more than GBP 30 billion in FDI thanks to sustained and coordinated efforts. PM Sunak underlined that the amount is ‘a vote of confidence in the future of the UK economy.’ Last year, the UK managed to create some 107,000 high-paying jobs through investment.

The focus of the UK is to attract #FDI into #AI, #BioTech and #EnergyTransition. During his keynote address, PM Sunak highlighted some of the major investment projects:

| NO. | INVESTOR | PROJECT(S) | GBP B |

|---|---|---|---|

| 1 | Australia IFM Investors | Energy Transition and Large Infrastructure | 10 |

| 2 | Spain Iberdrola | Renewable Energy | 7 |

| 3 | Australia Aware Super | Energy Transition, Digital Infrastructure, Affordable Housing, … | 5 |

| 4 | USA Microsoft | AI and Data Centers | 2.5 |

| 5 | Japan Nissan | EV and Battery Gigafactory | 2 |

| 6 | Switzerland Partners Group | Offshore Wind, Green Heating | 1.5 |

| 7 | Germany BioNTech | Biotech Lab in Cambridge and Centre of Expertise in London | 1 |

| 8 | USA Ellison | Interdisciplinary R&D Center in Oxford | 1 |

| 9 | Holland Yondr | Data Center in Slough | 1 |

| TOTAL | 31 |

“The UK is a world-leader in renewable energy and green industries. We have attracted £200B in low carbon investment since 2010, with another £100B expected by 2030, as we lead the 2nd industrial revolution.”

UK Energy Security Secretary Claire Coutinho

Last week, UK Finance Minister Jeremy Hunt chipped in with a budget of GBP 4.5 billion to support strategic sectors such as Electric Vehicles (#EV), #GreenEnergy and #LifeSciences. Finance Minister Hunt also allocated another GBP 7 billion for the Growth Fund targeted at #SME and #startups with the goal to spur job creation.

The UK recently hosted the #AI Safety Summit to discuss the regulatory framework as the technology is progressing by leaps and bounds. Furthermore, the UK Government has put forward the National Quantum Strategy in a bid to foster innovation in #QuantumComputing.

PM Sunak underscored that the UK has one of the most attractive visa policies for top talent. In fact, nearly half of all founders of hitech companies in the UK were originally immigrants.

Our High Potential Individual Visa means that if you’re a young person who’s graduated from a Global Top 50 University, you can just come to the UK and stay here, with your family, for two years to just explore, work, study and invent.”

UK PM Rishi Sunak

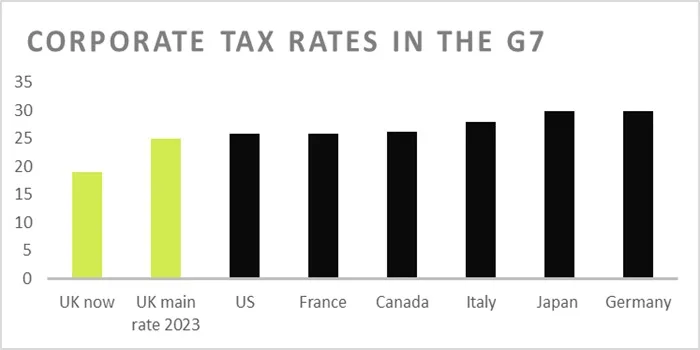

He went on to highlight that the UK has the lowest Corporate Tax Rate among the #G7 despite a hike from 19% to 25% in April 2023. In addition, the UK boasts lower Capital Gains Tax than France, Germany, Italy and Japan. The UK also has one of the most generous fiscal regimes towards Stock Options and Capital Expenditures Allowances.

The UK has also come up with the Lifetime Skills Guarantee program which supports adults to retrain at any stage of their careers in the face of unprecedented pace of change and to seize new opportunities brought about by disruptive technologies.

Furthermore, the UK has a long tradition of innovation backed by an excellent education system. As a matter of fact, UK has placed three of its universities in the Global Top 10. Despite accounting for less than 1% of the world population, the UK ranks 2nd in terms of producing Nobel laureates. It is also worth noting that the UK is just behind the US and China when it comes to nurturing tech Unicorns.

With a competitive tax regime, a strong culture of innovation and an assortment of favorable policies towards global talent and key sectors, the UK is undoubtedly ‘pro-innovation, pro-growth and pro-business’ and is willing to offer the ‘royal treatment’ to investors.