BII Makes Handsome Profit by Selling Stake in Ayana Renewable Power in India

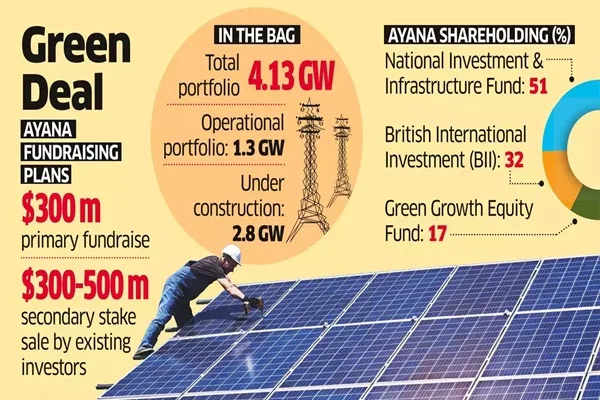

On 12 February 2025, the British International Investment (BII) was pleased to announce that it has signed a share purchase agreement (SPA) with ONGC Green Private to sell Ayana Renewable Power, its pioneering renewable energy company in India. The deal is valued at USD 2.3 billion with Ayana boasting a portfolio of over 4 GW of operational and under-construction projects. ONGC Green Private is a 50:50 JV between ONGC and NTPC Green Energy.

“BII launched Ayana in 2018 to play a catalytic role in accelerating the adoption of renewable power in India. In mobilising well over $1 billion in capital for the business over the last eight years, BII along with Eversource Capital and NIIF have achieved that goal. I am excited for the future of Ayana and the wide range of opportunities in the market for BII to support India’s drive towards net zero.”

BII Asia Head Srini Nagarajan

(Source: Economic Times of India)

It is to be recalled that BII created Ayana in 2018 as part of the efforts to accelerate the #EnergyTransition in India. Since then, Ayana has attracted investments from both the public and private sectors. Currently, Ayana is majority-owned by National Investment and Infrastructure Fund (NIIF) with a 51% share, while British International Investment has 32% stake and Eversource Capital holds the remaining 17%.

India has committed to achieve #NetZero by 2070 and to upscale the proportion of renewables in its national energy mix by at least 500 GW by 2030. Ayana has also been rated as the best-in-class ESG rating in Asia and is among the top three globally in the renewable energy sector.

“With Ayana well-positioned for its next phase of growth, this transaction enables us to unlock value while continuing to catalyse global institutional capital into transformative infrastructure opportunities. We look forward to seeing Ayana continue its momentum, building on the strong foundation we have established to further accelerate India’s clean energy transition.”

NIIF Managing Partner Vinod Giri

On the seller’s side, Standard Chartered acted as transaction advisor while Khaitan & Co. and Cyril Amarchand Mangaldas acted as legal advisors. On the buyer’s side, Deloitte Touche Tohmatsu India acted as the transaction advisor while JSA Advocates & Solicitors provided legal support.

As the decarbonization drives accelerates in India and around the world, the appetite of investors for green deals has markedly increased.