World’s Largest EV Battery Maker CATL Files for Hong Kong IPO to Raise at Least $5B

On 11 February 2025, Contemporary Amperex Technology Company Limited (CATL) submitted its application to be listed on the Hong Kong Stock Exchange (HKSE). The nominal value of the share is set at RMB 1 and the Initial Public Offering (IPO) is expected to raise in excess of USD 5 billion.

It could be the largest IPO in Hong Kong since Kuaishou Technology‘s USD 6.1 billion listing in 2021. The HKSE has been battered down since the COVID pandemic. Prior to the pandemic, annual listings managed to raise on average USD 30 billion annually, while after the COVID, the stock market manages to raise only USD 10 billion.

The listing in Hong Kong will constitute a secondary listing as it is already listed across the border at the Shenzhen Stock Exchange. CATL (SZSE: 300750) currently has a market capitalization was USD 152 billion.

The company is headquartered in the city of Ningde in the province of Fujian on the east coast of China. Over the years, CATL has been pursuing an aggressive overseas expansion strategy. In that regard, it has set up factories in Germany, USA, and Indonesia, with new plants in Hungary, Spain, Mexico and Thailand in the pipeline.

CATL is the world’s largest manufacturer of state-of-the-art rechargeable batteries which are experiencing a robust demand as the world accelerates the #EnergyTransition. In 2024, its global market share for Electric Vehicles (#EV) batteries was 38% and that for Energy Storage Systems (#ESS) batteries was 40%.

Based on its annual reports, CATL plans to utilize the funds to fuel its overseas expansion, in particular the #gigafactory being built in Hungary. The cost of the battery plant is estimated at USD 5.1 billion and CATL has already spent EUR 700 million on the project to date.

Recently inaugurated US President Trump has also slapped tariffs on Mexico, Canada and China and threatened to do the same to the EU ‘very soon.’ The ‘America First’ policy has thus thrown the EU and Canada into the arms of China, which sees an opportunity to reinforce economic ties with them.

In January 2025, the US Department of Defense placed CATL on the DoD restricted list, fearing over-reliance on China and alleging close ties between CATL and the Chinese military. Thus, the US military will not use CATL batteries, and US civilian firms are also discouraged from using batteries made in China.

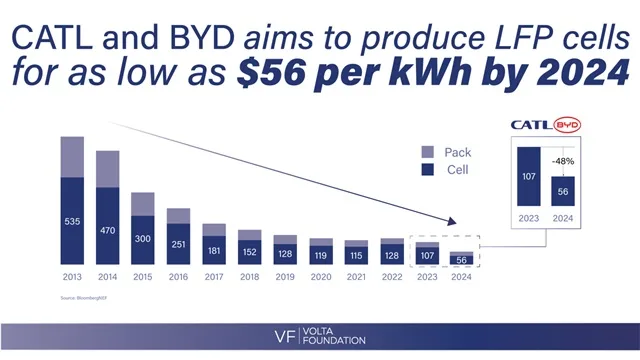

American EV maker Tesla is one of the major customers of CATL and analysts believe that it might prove challenging to switch suppliers because CATL not only has a price advantage, but also a technological edge, specifically in terms of Lithium Iron Phosphate (#LFP) battery technology. In fact, the client list of CATL reads like the who’s who of the car making world, with big names such as Mercedes-Benz, BMW, Hyundai, Volkswagen (Audi, Porsche), Ford and so on.

Chinese battery makers are dominant with nearly 70% of the global market. Behind CATL, BYD comes in second with a 17.2% global market share. South Korea is also a major player in this space with LG Energy (12.1%), SK On (4.8%), and Samsung SDI (4.5%).

Bank of America, China International Capital Corporation (CICC), CSC Financial and JP Morgan Chase are sponsoring the entry of CATL on the Hong Kong Stock Exchange. Goldman Sachs, Morgan Stanley and UBS are also among the arrangers for the #IPO which is anticipated to impart new dynamism into the stock market.