Africa Lost Top Spot to Middle-East According to BRI Report 2024 from Fudan University

Fudan University and Griffith University released the annual ‘China Belt and Road Initiative (BRI) Investment 2024‘ report at the end of February 2025. The key findings and trends are quite interesting to note.

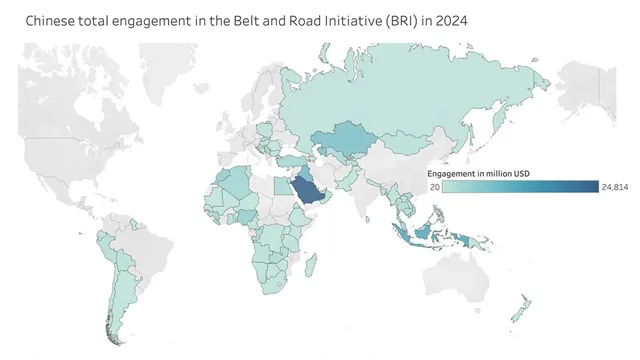

Africa lost the top spot to the Middle-East as the region with the highest value of Chinese projects. Indeed, during 2024, Chinese engagements in the Middle-East reached USD 39 billion, while Chinese projects in Africa totaled USD 29 billion.

The Middle-East rose to the top thanks to a few large projects in the energy sector. Specifically in 2024, China and Iraq sealed a deal to build the Al-Faw refinery with a capacity of 300,000 barrels per day (bpd) to the tune of USD 8 billion.

It is to be recalled that discussions around the Al-Faw project started as early as 2021. Now, the Al-Faw project is expected to morph into a Refinery and Petrochemical Complex and is expected to mobilize a whopping USD 20 billion. Al-Faw will be a multi-year, multi-faceted project comprising of one refinery, two petrochemical plants and a 2-GW power plant.

In Saudi Arabia, China is also deploying large-scale solar farms with energy storage systems. As a matter of fact, Saudi Arabia stood out as the country with the highest value of projects with China. Thanks to a close alignment between the Saudi’s #Vision2030 and China’s #BRI, bilateral cooperation led to over USD 50 billion of projects between 2016 and 2024.

Overall for 2024, China registered USD 71 billion in infrastructure contracts and USD 51 billion in #ODI projects under #BRI. The infrastructure project may be self-financed or financed by China. Since the #BRI was launched in 2013, China has cumulated USD 1.2 trillion of engagements.

Sector wise, energy remains the largest beneficiary with 33% of the total engagements. Interestingly, mining has emerged as the 2nd most attractive sector with 18% of total engagements as Chinese companies hunt for #CriticalMinerals.

Another emerging trend is the delocalization of #EV ecosystem overseas due to a combination of increasing tariffs and emerging markets. Thus, we note BYD’s USD 1.3 billion assembly plant in Indonesia and Gotion’s plant in Slovakia for roughly the same amount. Ironically, Spain — which has not signed the BRI MoU — received USD 4.2 billion for a #lithium phosphate (#LFP) battery plant based on a JV between CATL and Stellantis, and another USD 3.2 billion in investment for Green Hydrogen (#GH2) projects.

Despite the announcement in September 2021 to stop coal-fired power plants projects overseas, China continues to build coal-fired power plants and undertake coal-related projects, notably the Bangladesh Barisal II and Bosnia Gacko II. In addition, Power China also has several coal-fired plants in Mongolia and Bangladesh, while Zhejiang Energy bought into the Indonesian coal mining sector.

As far as the stated policy to privilege ‘small and beautiful’ projects, the average size of investments did decrease from USD 772 million in 2023 t USD 672 million in 2024. As for infrastructure projects, the average deal size actually shot up from USD 394 million in 2023 to USD 498 million in 2024.

In 2025, we can expect sustained BRI activity in the traditional sectors of infrastructure, as well as in energy and mining. China has identified Electric Vehicles, Rechargeable Batteries and Renewable Energy as the ‘New Three’. With a slowdown in the domestic economy, more and more Chinese companies are thus ‘going abroad’ to seek new opportunities.