IMF Forecasts Sub-Saharan Africa to Grow by 3.6% in 2024 and 4.2% in 2025

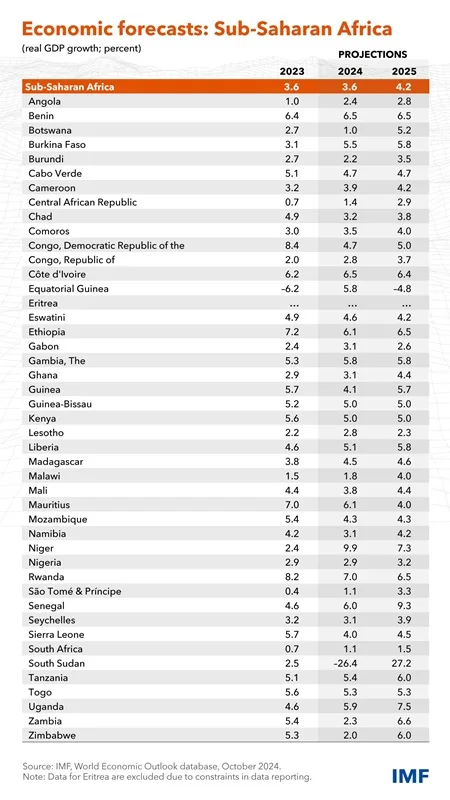

In its report on the Regional Economic Outlook for Sub-Saharan Africa (SSA), the International Monetary Fund (IMF) estimates the region is projected to grow by 3.6% in 2024 and is expected do a little better in 2025 with a growth rate of 4.2%.

On 25 October 2024, Mr Abede Selassie, Director of African Department of the IMF, and Mr Kwabena Akuamoah-Boateng, IMF Communication Officer, presented the key findings of the report during a Press Briefing in Washington DC during the Annual Meetings of the International Monetary Fund (IMF) and World Bank (WB) Groups.

For 2024, the top 10 fastest growing economies in SSA are forecasted to be: (1) Niger 9.9%, (2) Rwanda 7.0%, (3) Benin 6.5%, (4) Cote d’Ivoire 6.5%, (5) Ethiopia 6.1%, (6) Mauritius 6.1%, (7) Senegal 6.0%, (8) Uganda 5.9%, (9) Equatorial Guinea 5.8%, and (10) The Gambia 5.8%. With Ethiopia in the Top 10, other large economies in SSA such as Kenya, Nigeria, and South Africa will register growth rates of 5.0%, 2.9%, and 1.1% growth respectively.

From a regional bloc perspective, the ranking in descending order of growth rates is as follows: COMESA (SSA members only) 5.9%, WAEMU 5.7%, EAC-5 5.5%, ECOWAS 4.0%, SADC 2.8%, CEMAC 2.5%, and SACU 1.7%.

Despite a relatively lacklustre performance compared to pre-pandemic years, SSA is still home to nine of the world’s twenty fastest-growing economies. Compared to emerging economies with similar population sizes, the Sub-Saharan Africa region is somewhat lagging behind: India is expected to grow by 7% in 2024 while China is forecasted to grow at 4.8%.

When it comes to public debt, the IMF notes that the Debt-to-GDP ratios are stabilizing at a median of 58%, albeit at a higher level compared to the pre-pandemic period. Therefore, access to financing remains a challenge with the cost of financing rather high. Nevertheless, the IMF has provided USD 60 billion in financing to this youthful region full of potential since 2020.

Resource-rich countries with economies overly reliant on a single sector are highly vulnerable to price fluctuations on the global market and are not as resilient as those which have carried out a successful diversification strategy.

It is also noted that countries which borrow for #CapEx rather than #OpEx tend to fare better at later stages. Infrastructure development is in fact an investment in the future and contributes to make nations more attractive for #FDI.

In conclusion, Africa countries must strike a delicate balance among three objectives: Macroeconomic Health, Development Imperatives and Socio-Political Expectations.