Sumitomo Ponders Divesting from World’s Largest Nickel Mine in Madagascar

Faced with ‘insurmountable challenges’, Sumitomo plans to sell its stakes in the #nickel and cobalt mining operations in Ambatovy, Madagascar. The Ambatovy operations are split into extraction by Ambatovy Minerals and refining by Dynatec Madagascar. Sumitomo Corporation (JPX: 8053) is the controlling shareholder in these companies with a 54.2% share, with the remaining stake held by Korea Mine Rehabilitation and Mineral Resources (KOMIR).

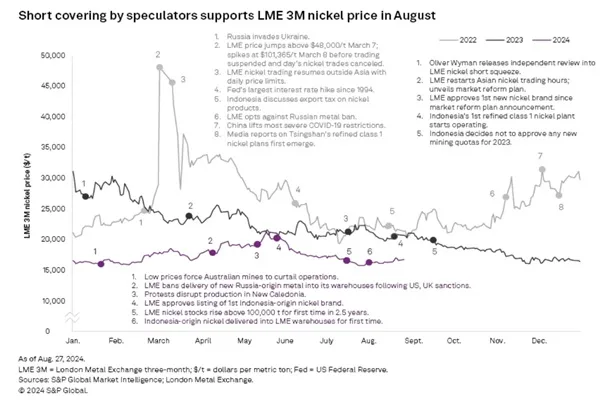

Firstly, the Ambatovy mine produced only 31,000 tonnes of nickel, below the target production of 40,000 tonnes of nickel during the last financial year. Secondly, despite being one of the #CriticalMinerals, nickel has seen its price trend down on the global market. Therefore, these factors negatively impacted the earnings with a shortfall estimated at USD 600 million from the Ambatovy operations.

Anticipating below-expectation results, Sumitomo initiated a restructuring plan in a London court in August 2024. Sumitomo did not make public details of the plan, but stated that ‘all options are on the table with a decision to be taken in the best interest of stakeholders.’

It is worth noting that the Ambatovy mine is one of the world’s largest nickel mines, and it also produces #cobalt from the laterite ore. It represents one-third of Madagascar’s total exports and is thus a significant earner of foreign currencies. At the moment, it is not clear what assistance the government of Madagascar can extend, given the weight of Ambatovy in the economy of the country.

The decrease in output was apparently caused by ‘a pipeline issue.’ At one point, production had to be halted. At the end of October 2024, production resumed, but the output forecast is expected to be revised to a lower level.