Zijin Locks in Manono Lithium Resources in DRC and Plans Production by 2026

On 10 January 2025, Zijin Mining (SHSE: 601899) announced that it is negotiating with Zangge Mining (SZSE: 000408) for a possible friendly acquisition. In particular, Zijin is in talks with the top two shareholders of Zangge: Tibet Zangge Venture Capital and Ningbo Meishan Bonded Port Area Xinsha Hongyun Investment Management Company. Collectively, the two companies own a 40% stake in Zangge Mining.

It is worth noting that Zijin is already involved in the Julong copper mining project in Tibet, which is a joint venture (#JV) with Zangge. Therefore, the two parties know each other well for having been working together. Now, Zijin and Zangge plan to expand the output of the Julong mine to 350,000 tonnes per day, propelling it as the largest copper mine in China.

Zijin Mining recent moves highlight the company’s strategy to cash in on the accelerating adoption of Electric Vehicles (#EV) and the growing demand for #CriticalMinerals such as #Copper and #Lithium.

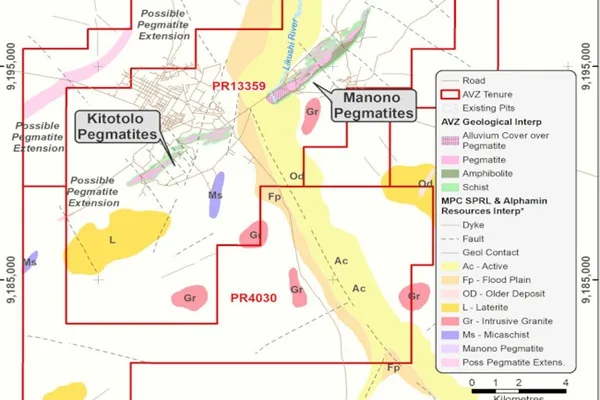

At the same time, Zijin Mining announced that production at the Manono lithium mine in the Democratic Republic of Congo (DRC) is expected to commence in 2026 despite a dispute with AVZ Minerals over exploration rights. The Australian firm has initiated arbitration proceedings against both Zijin Mining and the Government of DRC in an effort to recover its exploration license for the #lithium mine.

Zijin Mining is already active in the #Copperbelt region through the mining of copper and cobalt. In fact, Zijin Mining has stakes in two copper mines in DRC, including a 39.6% ownership in the giant Kamoa-Kakula Copper Complex, through a partnership with Invanhoe Mines.

The expansion plan for lithium comes amidst a sharp drop of 90% in the price of lithium on the world market from its peak in 2022. However, the long-term prospects remains positive as the #EnergyTransition is accelerating. These new acquisitions are in line with the strategy to build up reserves at value prices in order to lock in strategic resources.

The feasibility study on Manono lithium mine revealed that even with the current low lithium price, the mining operations would still be profitable. Zijing Mining plans to invest in the #Manono Lithium to make it the 3rd largest lithium mine in the world, behind Albermarle’s Greenbushes mine in Australia and Ganfeng’s Goulamina mine in Mali.

At closing on Friday 10 January 2025, the market capitalization of Zangge Mining was estimated to be about CNY 47 billion (USD 6.4 billion). With its foray into lithium, Zijin Mining will consolidate its position as a leader in #CriticalMinerals as it is already the world’s largest cobalt producer and the world’s 2nd largest copper producer.

Pingback: China and African Partnership in Resource Development – Calculus